NH MULTIFAMILY FUND III

Value-Add B/C Class | Small Multifamily Properties | Throughout NH

A 506(c) Offering for Accredited Investors Only

March 1, 2026

Third Round Closes

$50k

Minimum Investment

15-17% IRR

Projected to LPs

5-7 yrs

Anticipated hold

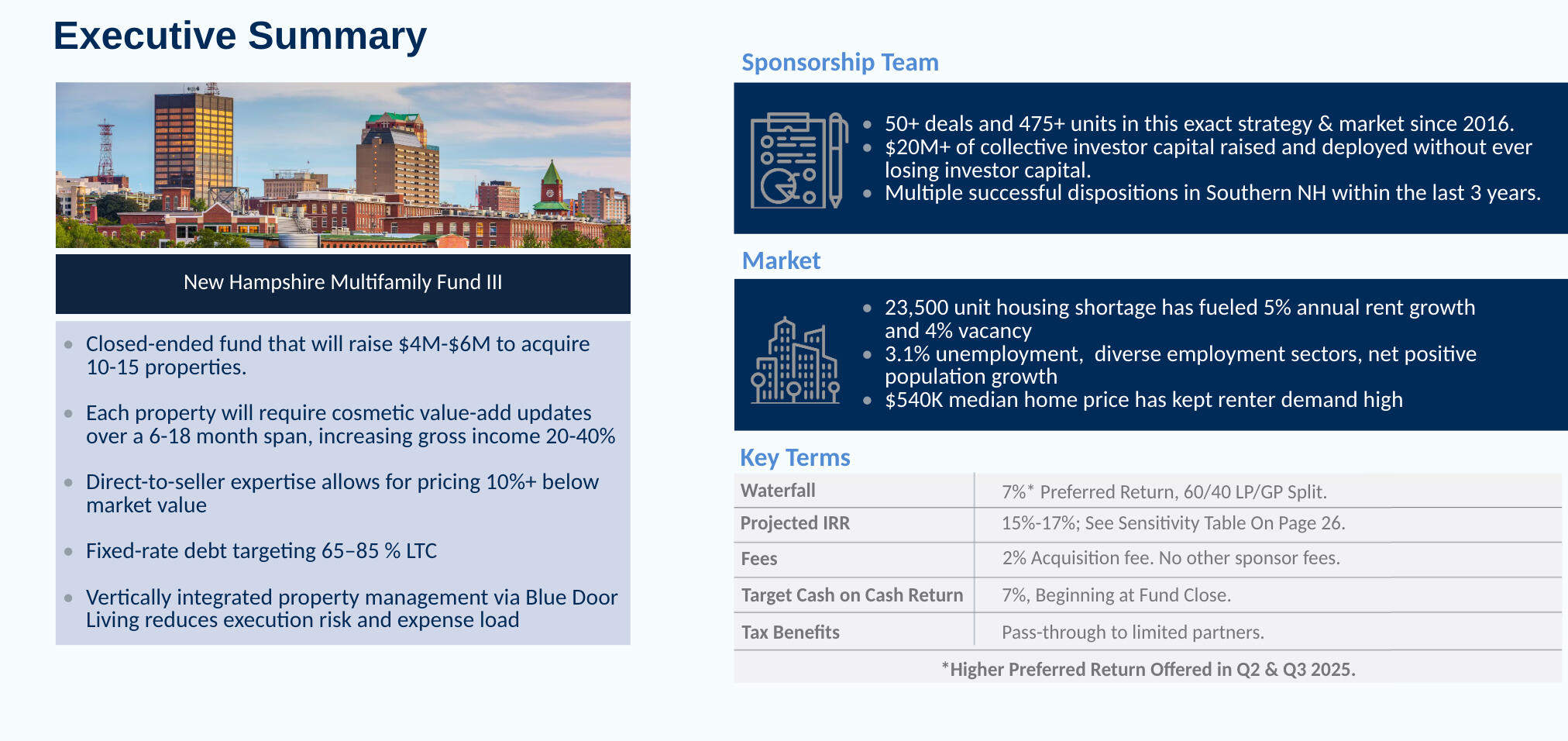

About This Fund

We've found the best opportunity in buying small, inefficiently priced assets in a market where we've built a significant track record.The problem is that it's historically been difficult for passive investors to participate in small deals. The solution is to group small assets into a larger fund, which gives investors diversification across 10-15 properties.This fund will acquire sub-50-unit B/C-class multifamily assets throughout New Hampshire, predominantly through a direct-to-seller approach that we've cultivated over the last decade. We are primarily focused on assets where our team, which has been the principal party in 50+ transactions in using this exact strategy, with the vast majority happening in the last three years.Our vertically integrated platform allows us to source deals directly from owners, then operate the asset with our own team in NH. Our vertically integrated platform aligns interests with our investors & significantly reduces execution risk associated with buying and holding multifamily properties versus using 3rd-party, unaligned site staff/PMs.

Prior Performance

Manchester/Farmington Portfolio

23 units • Closed Dec 2022

Returned 80% capital within 13 months

120 Myrtle St, Manchester

23 units • Closed Jun 2023

Returned 100% capital in 14 months

Lakeside Landing

Apts

45 units • Closed Jul 2023

$6.5M -> $8.5M in 24months

NH Small MF Portfolio II

27 units • Closed Feb 2024

Returned 20% capital in 14 months

Rochester Portfolio

13 units • Closed May 2024

Returned 35% capital in 12 months

Sterling Realty Apts

72 units • Closed December 2024

Rent roll ↑ $18% in in 5 months

Sponsorship Team

Axel Ragnarsson

Aligned Real Estate Partners

Axel Ragnarsson is the principal at Aligned Real Estate Partners either directly owns or has a GP interest in 450+ units of multifamily real estate and has been a principal party in $60M+ worth of transactions.Axel has directly sourced, raised capital, and operated mid-large multifamily transactions in numerous markets throughout the U.S., including Florida, Indiana, New Hampshire, and Texas. He is also a founding partner of Blue Door Living, a property management company based in New Hampshire which currently manages over 800 units of small to mid-sized multifamily real estate. Axel is also the host of The Multifamily Wealth Podcast, one of the most highly rated multifamily real estate podcasts in the industry.

TJ Burns

Burns Capital Partners

TJ Burns is the Founder & Principal of Burns Capital Partners, an emerging real estate investment company. TJ has raised $12M in investor equity from 100+ investors across 8 offerings, with 5 offerings structured as joint ventures with Aligned Real Estate partners. TJ started Burns Capital Partners in 2022, after 3 years spent actively investing in single family & small multifamily, and passively investing in various asset classes.Before real estate, TJ was a lead mechanical engineer at Blink, a smart home devices division of Amazon. He holds a degree in mechanical engineering from MIT and is an inventor on over 20 patents.

475+

Units Owned

50+

Transactions using this exact strategy

$20M

Collectively Managed

Zero Investor Losses and Zero Capital calls

227+

Units Owned

100+

Limited Partners

$20M

Collectively Managed

Zero Investor Losses and Zero Capital calls

Axel Ragnarsson

Aligned Real Estate Partners

Axel Ragnarsson is the principal at Aligned Real Estate Partners either directly owns or has a GP interest in 450+ units of multifamily real estate and has been a principal party in $60M+ worth of transactions.Axel has directly sourced, raised capital, and operated mid-large multifamily transactions in numerous markets throughout the U.S., including Florida, Indiana, New Hampshire, and Texas. He is also a founding partner of Blue Door Living, a property management company based in New Hampshire which currently manages over 800 units of small to mid-sized multifamily real estate. Axel is also the host of The Multifamily Wealth Podcast, one of the most highly rated multifamily real estate podcasts in the industry.

50+

Transactions using this exact strategy

475+

Units Owned

TJ Burns

Burns Capital Partners

TJ Burns is the Founder & Principal of Burns Capital Partners, an emerging real estate investment company. TJ has raised $12M in investor equity from 100+ investors across 8 offerings, with 5 offerings structured as joint ventures with Aligned Real Estate partners. TJ started Burns Capital Partners in 2022, after 3 years spent actively investing in single family & small multifamily, and passively investing in various asset classes.Before real estate, TJ was a lead mechanical engineer at Blink, a smart home devices division of Amazon. He holds a degree in mechanical engineering from MIT and is an inventor on over 20 patents.

227+

Units Owned

100+

Limited Partners

Want To Learn More?

© 2025 Burns Capital Partners & Aligned Real Estate Partners. All Right Reserve